So if you bought a stock for $1,000 and sold it for $2,000, you would realize a capital gain of $1,000. How capital gains are computedĪ capital gain is computed by subtracting the purchase price of an asset from the selling price. Tax efficiency is an important aspect of managing your investments and growing your net worth. Which assets qualify for capital gains tax?Ĭapital gains taxes are owed when an asset, such as investment securities, real estate or an investment property, is sold for more money than was paid for the asset. Sales taxes, meanwhile, are typically paid at the point of purchase when we buy retail goods and some services.īut there’s another kind of tax that’s often not as well-understood: capital gains taxes.

Income taxes are automatically withheld from pay or paid by independent contractors, self-employed individuals and some others based on how much money is earned. The post 2021 Capital Gains Tax Rates appeared first on SmartAsset Blog.Most people are familiar with two ways we pay taxes: income taxes and sales taxes. Photo credit: ©/Korrawin, ©/Jirapong Manustrong, ©/Geber86

Not all robo-advisors offer this perk, but some do, usually for a fee.

#CAPITAL GAINS TAX BRACKETS STOCKS PROFESSIONAL#

If you’re unsure, find one that offers you the chance to talk to a financial professional if you have questions about your specific needs. Robo-advisors aren’t necessarily right for everyone, but if you’re starting your investment journey or you don’t have complicated assets, you may want to give it a try. Many robo-advisors offer tax-loss harvesting, which sells investments that are hurting your portfolio and helps offset what you earn from the gains. You might also be interested in signing up for a robo-advisor.

If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

#CAPITAL GAINS TAX BRACKETS STOCKS FREE#

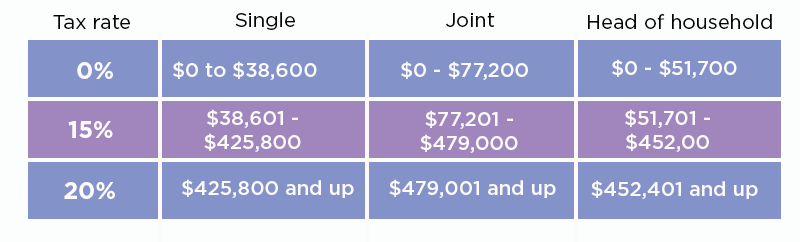

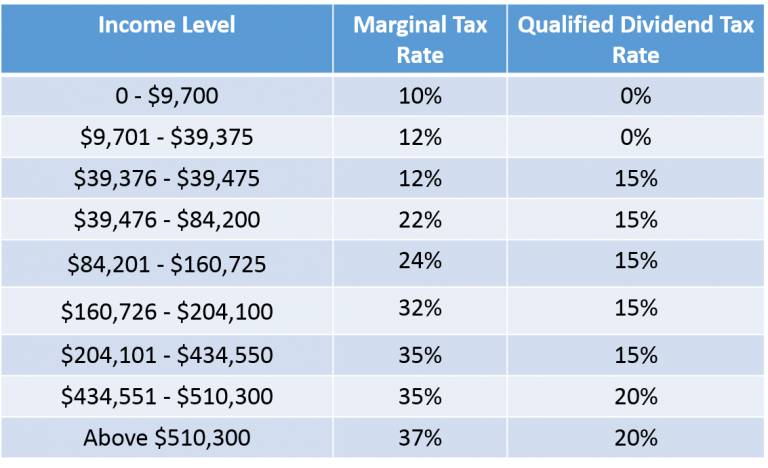

Need help with finding a financial advisor? SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. But knowing how long you will hold assets before selling, what the purchase and sales prices could be, as well as your tax filing status and income bracket can help you calculate how much you could owe in taxes. In 2021, capital gains tax rates for short term capital gains depend on income tax brackets, which also factor in filing status.Ĭapital gains can be tricky, especially if you wait too long to understand how they implicate your financial situation at tax time. Long-term Capital Gains Tax Rates for 2021 Long-term capital gains tax rates for 2021 are as follows: Short-term gains are taxed as ordinary income. Short-term capital gains come from assets held for under a year.īased on filing status and taxable income, long-term capital gains for tax year 2021 will be taxed at 0%, 15% and 20%. Long-term capital gains come from assets held for over a year. When an investor realizes a capital gain, any proceeds will be considered taxable income.Ĭapital gains vary depending on how long an investor had owned the asset before selling it. Making a profit means the investor now has income, of course, so this must be factored in when filing taxes. Let’s break down the tax rates for your capital gains in 2021.Ĭapital gains refers to the money that an investor makes as the profit from selling one or more of their investments or assets. A financial advisor could help you create a tax plan to maximize your investments. But what some investors may initially neglect to take into account is the fact that investment gains mean investment income, and investment income means taxes on investment income.

One of the draws of investing is the money you could potentially make in a relatively shorter amount of time than earning it through a part-time or full-time job.

0 kommentar(er)

0 kommentar(er)